Electricity costs in India continue to rise for homes, businesses, and farms. Solar power offers a smart solution: lower bills, predictable energy costs, and long-term savings. The good news? Financing a solar power plant in India is easier than ever—but only if you understand the process and prepare correctly.

This guide is designed for:

- Homeowners planning rooftop solar.

- MSME & commercial users installing solar to cut operating costs.

- Farmers & entrepreneurs setting up ground-mounted plants, including under PM-KUSUM.

By the end, you’ll have a clear roadmap on how to get loan for solar power plant in India—from planning to disbursement.

Understanding Solar Loans in India: The Basics

A solar loan is not just a personal loan. Most lenders treat it as asset-backed financing, where the solar plant itself generates savings or income to repay the loan.

Types of Solar Financing

. Rooftop Solar Loans

- Typically for homes and small businesses.

- Often linked to home loans or special green-energy schemes.

- Faster approval and simpler documentation.

- Competitive rooftop solar loan interest rates.

2. Ground-Mounted / Commercial Solar Project Finance

- Used for MSMEs, factories, and solar parks.

- Requires a Detailed Project Report (DPR).

- Loan approval depends on project viability and cash flows.

Common under commercial solar financing or utility-scale projects.

Are You Eligible? Key Criteria for a Solar Loan

For Individuals / Homeowners

- CIBIL score: Usually 650+ preferred.

- Property ownership proof (roof rights are essential).

- Stable income source.

- Acceptable debt-to-income ratio.

For Businesses / Commercial Entities

- Business vintage (typically 2–3 years).

- Audited financial statements.

- Positive or improving cash flows.

- Land or rooftop lease/ownership documents.

Tip: A stronger credit profile directly improves interest rates and loan tenure.

Government Subsidies and Schemes (Crucial Section) ☀️

Before calculating your loan amount, always factor in government subsidies. Your loan is usually required only for the net cost after subsidy.

National Rooftop Solar Scheme (Residential)

- Central subsidy for residential rooftop solar.

- Available only through MNRE-empanelled vendors.

- Subsidy is credited after installation and inspection.

- Reduces upfront cost significantly, improving the ROI of the Solar Power Plant.

PM-KUSUM Yojana Loan

- Designed for farmers and rural entrepreneurs.

- Supports ground-mounted and solar pump projects.

- A combination of subsidy + bank loan + beneficiary contribution.

Excellent option for those seeking PM KUSUM yojana loan support.

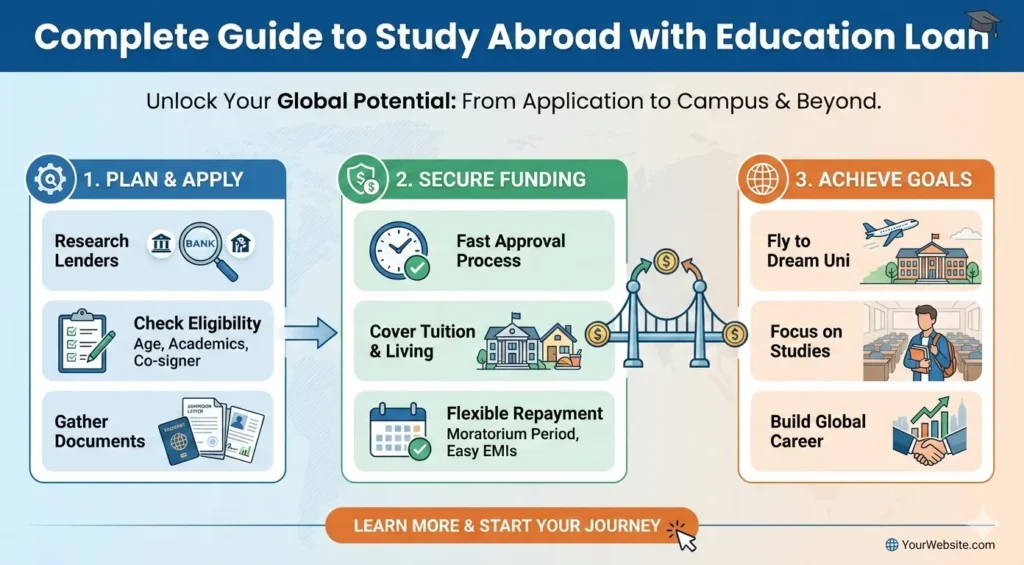

Step-by-Step Process to Get a Solar Power Plant Loan

Site Assessment & Feasibility Study

- Roof strength, shadow analysis, and land suitability.

- Expected generation and savings estimation.

2. Choosing an EPC Contractor (Installer)

- Select an experienced, bank-approved EPC.

- Proper design and credible quotations improve loan approval chances.

3. Preparing the Detailed Project Report (DPR)

- Critical for commercial and large projects.

- Includes:

- Plant capacity & technology

- CAPEX & OPEX

- Generation estimates

- Cash flow & payback period

- A strong DPR is the backbone of solar power plant project finance in India.

4. Applying for Subsidies (If Applicable)

- Residential: Through the MNRE portal/vendor.

- PM-KUSUM: Through state nodal agencies.

5. Approaching Lenders & Submitting Documents

- Compare public banks, private banks, and NBFCs.

- Submit financial, technical, and KYC documents.

6. Loan Sanction & Disbursement

- Sanction letter issued after appraisal.

Funds are usually disbursed directly to the EPC vendor in stages.

Documents Required Checklist for a loan for a Solar Power Plant

| Category | Documents |

|---|---|

| KYC Documents | Aadhaar, PAN, address proof, photographs |

| Financial Documents | ITR (2–3 years), bank statements (6–12 months), balance sheet (for businesses) |

| Project-Related Documents | EPC quotation, DPR, land/roof ownership proof, PPA or net-metering approval |

Having this documents required for solar loan checklist ready can cut approval time significantly.

Top Lenders for Solar Financing in India

Instead of focusing on one lender, explore categories:

Public Sector Banks

- SBI Solar Loan Scheme

- PNB, Bank of Baroda

- Competitive rates, longer tenures

Private Banks

- HDFC Bank

- ICICI Bank

- Faster processing, flexible structures

NBFCs & Green Energy Specialists

- IREDA loan for solar project

- Tata Capital

- Specialized understanding of renewable projects

Pro tip: NBFCs are often more flexible for commercial solar financing. Also, you can get any type of loan from Credveda, one of the best Financial Solutions in India, which offers low interest.

Conclusion

Understanding how to get loan for solar power plant in India is about preparation—not complexity. With the right feasibility study, a solid DPR, and proper use of subsidies, solar loans become highly accessible.

The long-term ROI of a solar power plant—through savings, stable energy costs, and environmental benefits—far outweighs the initial financing effort.

Frequently Asked Questions on Solar Loans

A: Interest rates typically range from 8.5% to 12%, depending on borrower profile, lender type, and project size.

A: Usually no. Most lenders finance 70%–90% of the project cost. Subsidies can reduce your equity requirement.

A: For small residential systems, collateral-free loans are common. Larger commercial projects may require collateral or guarantees.

A: Tenure ranges from 5 to 15 years, aligned with the cash flow and life of the solar plant.