If you are exploring the best loan, but in your mind have inequalities, that Which loan is best in India? Don’t worry, you have come to the right web page. where you clarify everything that you want to know.

When people need money for big expenses, they often think about taking a loan from a bank or financial institution. In India, two of the most popular types of loans are personal loans and home loans. But many people get confused about which one is better. The truth is, the best loan depends on your purpose, repayment ability, and long-term plans.

What Is a Personal Loan?

A Personal Loan is a type of unsecured loan, which means you do not have to give any collateral or security to the bank. This makes it easy and fast to get.

Common Uses of Personal Loans

People usually take personal loans for:

- Medical emergencies

- Travel

- Wedding expenses

- Home repair or renovation

- Buying gadgets or appliances

- Education expenses

Key Features of a Personal Loan

- No collateral required

- Quick approval—sometimes within 24 hours

- Higher interest rates

- Shorter repayment period (1–5 years)

Smaller loan amounts (usually up to ₹20–25 lakh)

What Is a Home Loan?

A home loan is a type of secured loan, which means the property you buy acts as the collateral. The bank uses your house or land as security until the loan is paid off.

Common Uses of Home Loans

People use home loans to:

- Buy a new house

- Construct a house

- Purchase a plot

- Renovate or extend a home

- Transfer an existing home loan to another bank

Key Features of a Home Loan

- Lower interest rates

- Long repayment tenure (up to 30 years)

- Large loan amounts (up to crores)

- Requires documents like property papers

Longer approval time

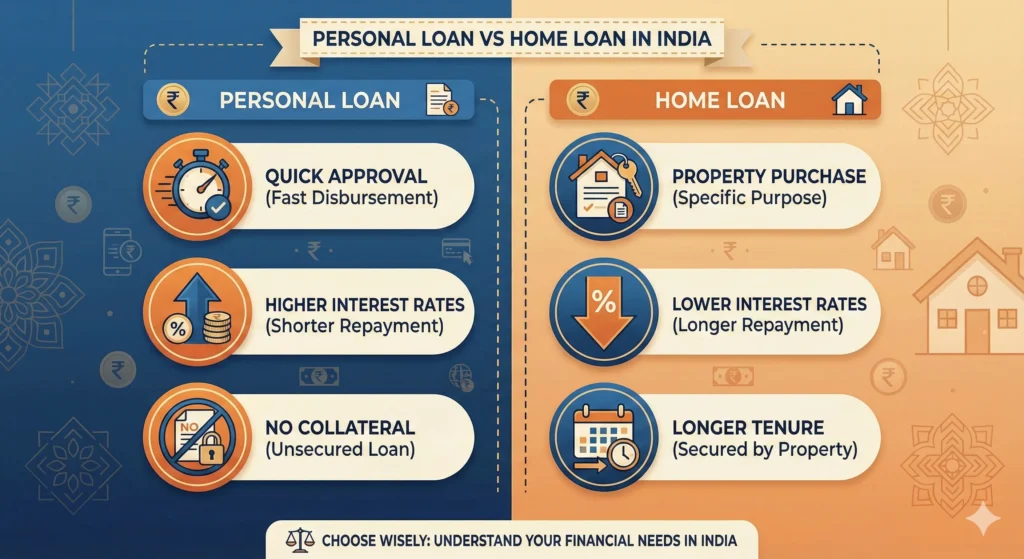

Personal Loan vs Home Loan: Key Differences

Below is a simple comparison to help you understand which loan type fits your needs.

1. Purpose

- Personal Loan: Used for any personal need. No questions asked.

- Home Loan: Only for buying or improving property.

2. Interest Rates

Interest rate is one of the most important factors when choosing a loan.

- Personal Loan Interest Rate: Usually 10% to 24%

- Home Loan Interest Rate: Usually 8% to 11%

Home loans are clearly cheaper.

3. Loan Tenure

- Personal Loan Tenure: 1–5 years

- Home Loan Tenure: Up to 30 years

A longer tenure makes home loan EMIs (monthly payments) smaller and easier to manage.

4. Loan Amount

- Personal Loan Amount: Small, up to ₹20–25 lakh

- Home Loan Amount: Large, depending on your income and property value

5. Documentation

- Personal Loan: Very few documents required (ID, address proof, income proof)

- Home Loan: Many documents needed (property papers, builder details, registration documents, etc.)

6. Collateral

- Personal Loan: No collateral

- Home Loan: Property acts as collateral

7. Processing Time

- Personal Loan: Very fast

- Home Loan: Slower due to property verification

8. Tax Benefits

- Personal Loan: Usually, no tax benefits

- Home Loan: Strong tax benefits on principal and interest under sections 80C and 24(b)

Advantages of Home Loans and Personal Loans

| Advantages of Home Loan | Advantages of a Personal Loan |

|---|---|

| Low Interest Rates: This is the biggest benefit. Home loan interest rates are much lower than personal loan rates in India. | Quick and Easy: Personal loans are approved faster than home loans. Some lenders even provide instant personal loan approval online. |

| Long Tenure: You can repay the loan over 20–30 years, making EMIs affordable. | No Collateral Needed: You don’t have to risk losing your property. |

| High Loan Amount: You can borrow much more money compared to a personal loan. | Flexible Use: You can use the money for any need—education, travel, medical bills, or emergencies. |

| Tax Benefits: You can save a lot of money through income tax deductions. | Simple Documentation: Only basic documents are required. |

| Helps Build an Asset: By taking a home loan, you are buying property, which usually increases in value over time. | |

| But home loans involve paperwork, property checks, longer approval time, and you must be careful because the bank can take the property if you fail to pay. | However, personal loans also come with higher interest rates and short tenures, which makes EMIs larger. |

Which Loan Should You Choose?

To decide whether a personal loan is better or a home loan is better, answer these questions:

Why Do You Need the Money?

Choose a Personal Loan if:

- You need the money quickly

- You need it for personal use

- You don’t want to use any property as security

Choose a Home Loan if:

- You want to buy or build a house

- You need a large amount of money

- You want lower EMIs and long-term benefits

2. How Fast Do You Need the Loan?

- A personal loan is best for urgent needs.

- A home loan takes longer because banks check the property.

3. Can You Provide Collateral?

- If you don’t want to risk your property, choose a personal loan.

- If you are okay with using your house as collateral, consider a home loan with lower rates.

4. What EMI Can You Afford?

- Personal loan EMIs are higher because the interest rate and tenure are short.

Home loan EMIs are easier to manage due to lower interest rates and longer tenures.

Final thought: Which Loan Is Better?

There is no single answer to which is better—a personal loan or a home loan.

It completely depends on your purpose and financial situation.

✔ If you want money quickly without any property risk, choose a personal loan.

✔ If you want to buy a house and enjoy lower interest rates, choose a home loan. Both loans are useful, but for long-term financial growth, a home loan is usually the better choice because it helps you build an asset.

Conclusion:

Now you understand which loan is best in India. But choosing between a personal loan and a home loan depends on your needs, budget, and financial goals. If you want money quickly without giving any collateral, a personal loan is the better choice. It is flexible, fast, and easy to get. However, it comes with higher interest rates and shorter repayment periods.

On the other hand, if your goal is to buy, build, or renovate a home, then a home loan is the smarter option. Home loans offer lower interest rates, long repayment tenures, and tax benefits, making them more affordable in the long run. They also help you build a valuable asset—your own home.

In simple terms:

- Choose a personal loan for short-term needs and quick funds.

- Choose a home loan for long-term investment and property ownership.

By understanding your purpose and checking your repayment capacity, you can decide which loan is truly better for you.

FAQ: Which loan is best in India, Personal Loan vs Home Loan in India?

Q: What is the main difference between a personal loan and a home loan?

A: A personal loan is an unsecured loan, meaning you don’t need to offer any collateral.

A home loan is a secured loan, where the property you buy is used as security.

Q: Which loan has a lower interest rate?

A: Home loan has a much lower interest rate (usually 8%–11%).

A personal loan has a higher interest rate (10%–24%) because it has no collateral.

Q: Which loan is easier to get?

A: A personal loan is easier and faster to get.

It needs very few documents and can be approved within hours.

Q: Can I use a personal loan to buy a house?

A: The interest rate for a personal loan is much higher, and the loan amount is small compared to a home loan.

Q: Do home loans offer tax benefits?

A: Yes. Home loans offer tax benefits on both principal and interest under sections 80C and 24(b) of the Income Tax Act.

Q: Does a personal loan offer any tax benefits?

A: Normally, no. Personal loans do not usually give tax savings unless used for specific business or renovation purposes.

Q: Which loan should I choose for home renovation?

A: For small renovations, a personal loan is faster.

For big renovation projects, a home improvement loan (a type of home loan) is better because it has lower interest rates.

Q: Is a personal loan safer than a home loan?

A: A personal loan does not require collateral, so you don’t risk losing property.

However, EMIs can be higher, so you must repay on time to avoid penalties.

Q: Which loan has a longer repayment period?

A: A home loan has a very long tenure—up to 30 years.

A personal loan usually has a short tenure of 1–5 years.

Q: What should I choose if I need money urgently?

A: Choose a personal loan. It is processed faster and doesn’t need property verification.

Q: Which loan is better for building long-term assets?

A: A home loan is better because you end up owning a house, which increases in value over time.

Q: A home loan is better because you end up owning a house, which increases in value over time?

A: Yes, many people do. As long as you have a strong credit score and income to pay the EMIs, banks usually allow it.

Q: Which is better: a personal loan or a home loan?

A: The best loan depends on your needs, repayment ability, and financial goals.

- Choose a personal loan for quick money without collateral.

- Choose a home loan for buying a property with lower interest and long-term benefits.